Exploring the Rise of Digital Economies

Digital economies are reshaping our world at an unprecedented pace. From e-commerce to cryptocurrencies, the way we conduct business and manage assets is evolving rapidly.

At Piter, we’re witnessing firsthand how this digital transformation is impacting industries, creating new opportunities, and challenging traditional models. In this post, we’ll explore the key components driving digital economies and their far-reaching effects on society and business.

How Digital Technology Transforms Markets

The digital revolution reshapes traditional markets at breakneck speed. A massive shift from physical to digital assets occurs, with intangible goods like software, digital media, and online services becoming increasingly valuable. This trend stands out in the entertainment industry, where streaming platforms have largely replaced physical media sales.

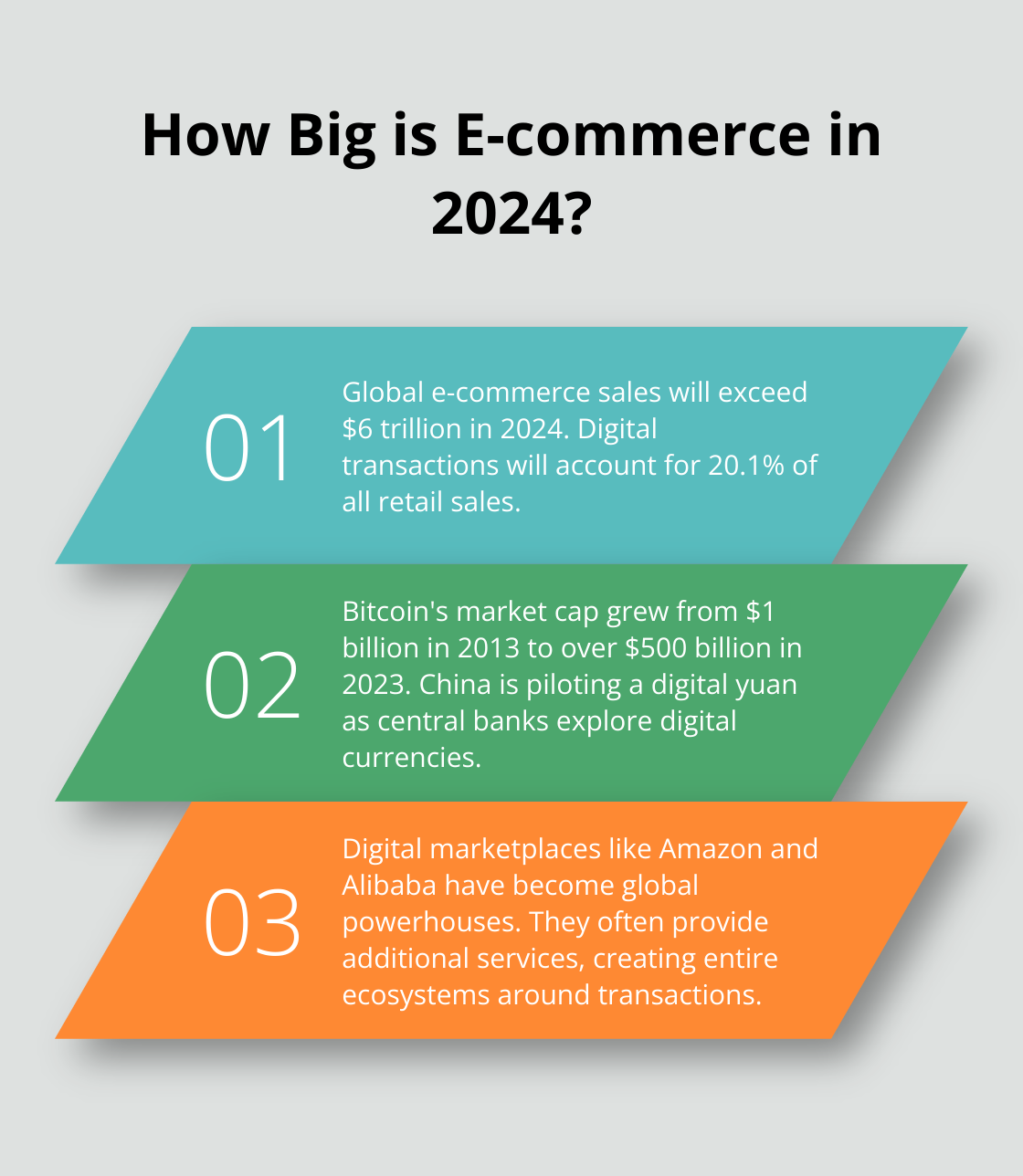

E-commerce Dominance

E-commerce has exploded in recent years. Ecommerce sales will cross the $6 trillion mark this year, and 20.1% of all retail sales will be conducted digitally. This growth changes how businesses operate and compete. Small businesses now reach global markets, while large corporations must adapt their strategies to stay relevant in the digital space.

The Rise of Digital Currencies

Cryptocurrencies and digital payment systems revolutionize financial transactions. Bitcoin, the first and most well-known cryptocurrency, has seen its market cap grow from $1 billion in 2013 to over $500 billion in 2023. Central banks worldwide also explore digital currencies, with China’s digital yuan already in pilot stages.

Digital Marketplaces Reshape Industries

Digital marketplaces transform how people buy and sell goods and services. Platforms like Amazon and Alibaba have become global powerhouses, while industry-specific marketplaces emerge in sectors from healthcare to education. These platforms often provide additional services (like logistics and payment processing), creating entire ecosystems around transactions.

Online Gambling: A Digital Frontier

The online gambling industry exemplifies the digital transformation of traditional sectors. Platforms like Wolfbet lead this change, offering a top-tier crypto gambling experience with substantial bonuses (up to $20,000 welcome bonus) and tournament prizes (up to $1 million). Wolfbet showcases how traditional industries reimagine themselves in the digital age, providing privacy through no-KYC poker policies and instant withdrawal options for a seamless gaming experience.

As markets continue to evolve, businesses must embrace digital technologies to remain competitive. This digital revolution doesn’t just change how we buy and sell; it redefines the very nature of value in our economy. The next section will explore the key components that power these digital economies and enable their rapid growth.

What Powers Digital Economies?

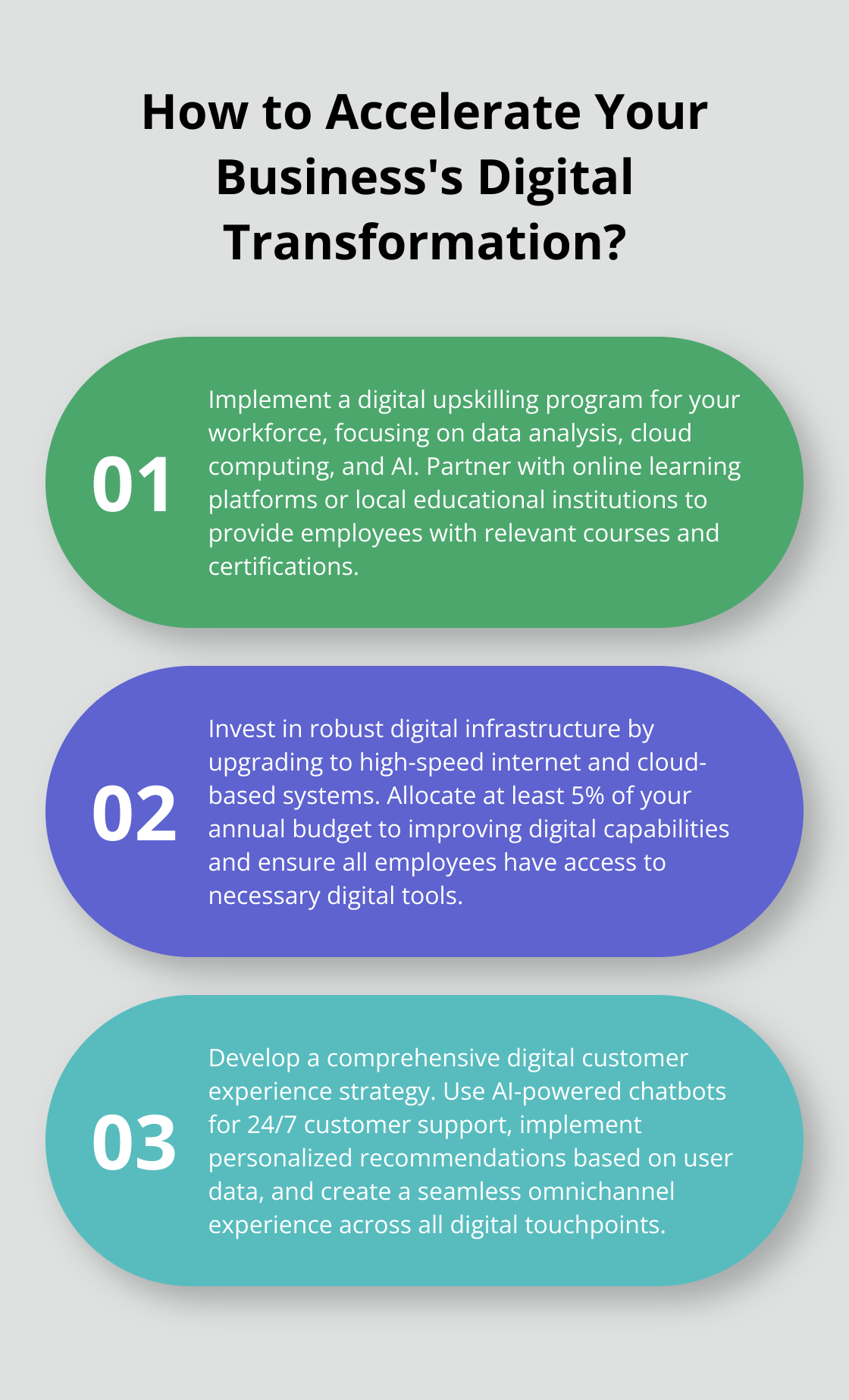

Digital economies thrive on a complex interplay of technological, human, and financial elements. At their core, these economies rely on robust digital infrastructure, a digitally skilled workforce, innovative financial services, and interconnected digital platforms.

The Backbone: Digital Infrastructure

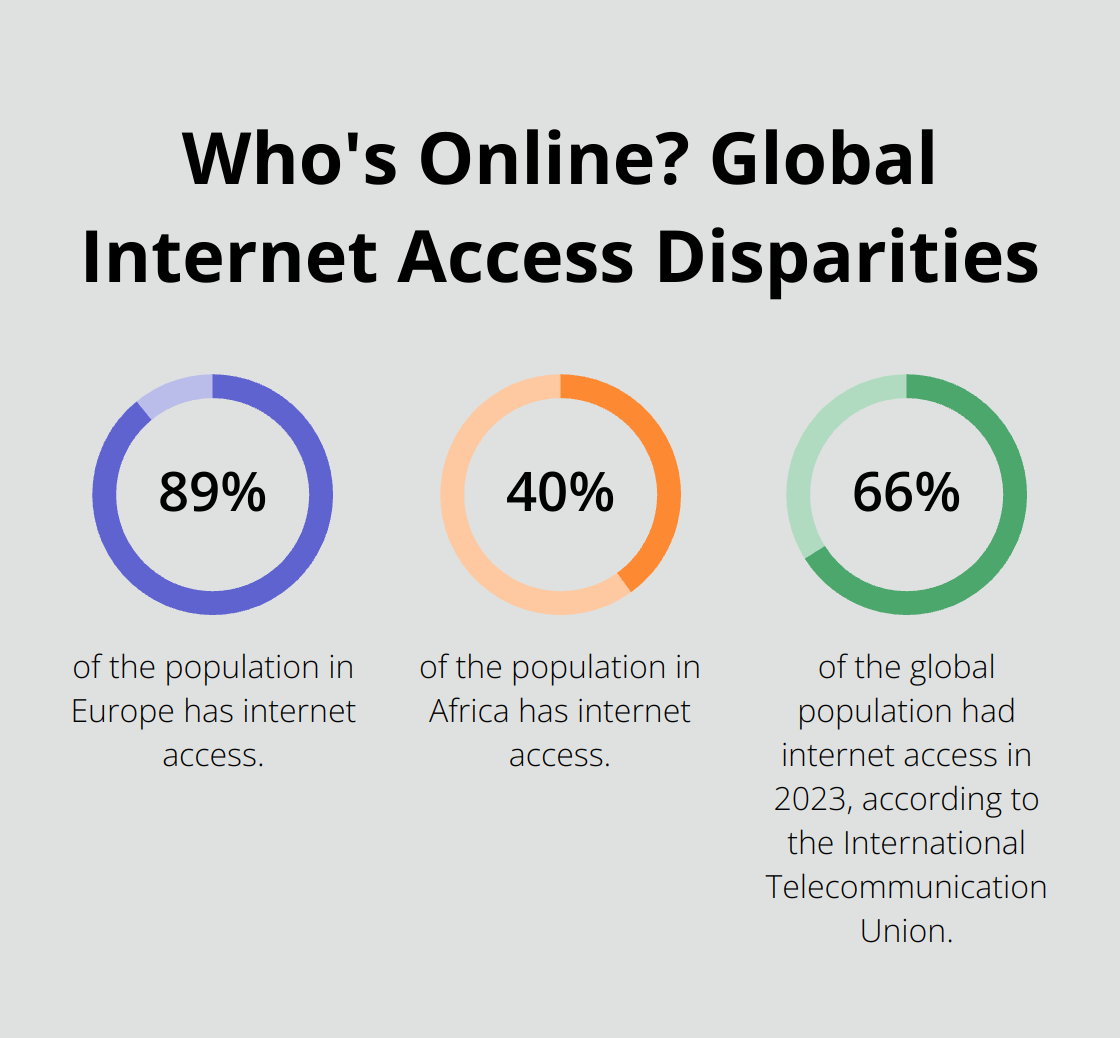

High-speed internet access forms the foundation of digital economies. Global internet penetration reached 66% in 2023, up from just 17% in 2005 (International Telecommunication Union). This growth enables more people to participate in the digital economy, but significant disparities remain. In Africa, only 40% of the population has internet access, compared to 89% in Europe.

To bridge this gap, governments and private companies invest heavily in broadband infrastructure. The European Union’s Digital Decade strategy aims to provide gigabit connectivity to all households by 2030. Such initiatives will foster digital innovation and economic growth.

Empowering the Workforce: Digital Skills

As digital technologies reshape industries, the demand for digital skills skyrockets. The World Economic Forum reports that 50% of all employees will need reskilling by 2025 due to increasing adoption of technology. This skills gap presents both a challenge and an opportunity for workers and businesses alike.

To address this, companies like Google and Microsoft offer free online courses in areas such as data analysis, cloud computing, and artificial intelligence. Governments also play a role, with countries like Singapore providing citizens with SkillsFuture credits for lifelong learning (including digital skills training).

Revolutionizing Finance: Digital Financial Services

Digital financial services transform how people and businesses manage money. Data from 2022 indicate a sustained level of financial inclusion, bolstered by the rise in digital financial services.

Cryptocurrencies and blockchain technology push the boundaries further. While Bitcoin grabs headlines, the real revolution lies in the potential of blockchain for secure, transparent transactions. Estonia’s e-Residency program, which allows digital entrepreneurs to start and run a global business in the EU, showcases how digital financial services can redefine business operations across borders.

Connecting the Dots: Digital Platforms

Digital platforms serve as the connective tissue of the digital economy, linking consumers, businesses, and service providers. These platforms streamline business processes and automate complex tasks-reducing the need for extensive manual labor, minimizing errors, and increasing efficiency.

The platform economy’s impact is substantial. Airbnb hosts over 4 million hosts worldwide, while Etsy connects 7.5 million active sellers with 96 million active buyers. These platforms create new economic opportunities but also raise questions about worker protections and market dominance.

In the realm of online gambling, platforms like Wolfbet exemplify how traditional industries adapt to the digital age. With its crypto-friendly approach, substantial bonuses (up to $20,000 welcome bonus), and focus on user privacy, Wolfbet demonstrates how digital platforms can offer enhanced experiences while addressing modern consumer needs.

As these components continue to evolve and intertwine, they shape the future of our global economy. The next section will explore how this digital transformation impacts society and business, creating new opportunities and challenges for individuals and organizations alike.

How the Digital Economy Reshapes Work and Business

The digital economy transforms how we work and conduct business. From remote work to AI-driven automation, its impact reaches far and wide.

The New World of Work

The job market experiences a seismic shift. The World Economic Forum predicts that machines may displace 85 million jobs by 2025. However, this shift also creates opportunities, with 95 million new roles potentially emerging to adapt to the new division of labor between humans and machines.

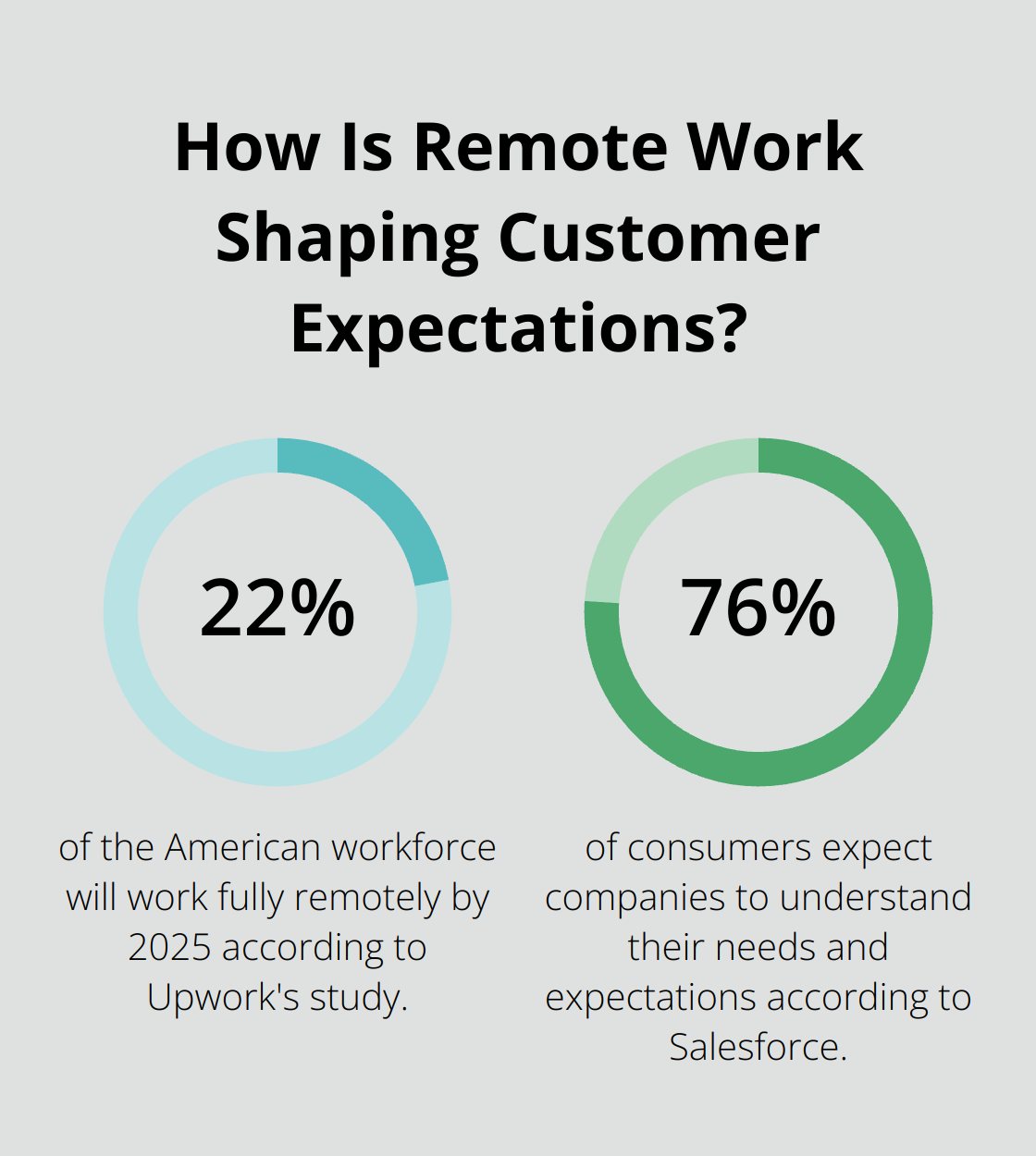

Remote work has become mainstream. Upwork’s study forecasts that 22% of the American workforce will work fully remotely by 2025. This shift opens global talent pools for companies and provides new opportunities for workers, especially in rural areas or developing countries.

Evolving Consumer Expectations

Digital natives reshape consumer behavior. They demand seamless, personalized experiences across all touchpoints. Salesforce reports that 76% of consumers expect companies to understand their needs and expectations.

This shift drives innovation in customer service. AI significantly impacts the loss of human decision-making and makes humans lazy. It also impacts security. Businesses that fail to adapt risk losing customers to more agile competitors.

Disruption Across Industries

Traditional business models crumble under the weight of digital disruption. The retail sector exemplifies this trend. E-commerce giants force traditional retailers to rethink their strategies. In 2023, e-commerce accounts for 20.8% of global retail sales (up from 7.4% in 2015).

The financial sector faces upheaval from fintech startups. Companies like Revolut and N26 challenge traditional banks, offering lower fees and more user-friendly interfaces. Global fintech funding reached $75.2 billion in 2022, highlighting the sector’s rapid growth.

In the gambling industry, crypto-friendly platforms lead the charge. Wolfbet stands out with its substantial bonuses (up to $20,000 welcome bonus) and focus on user privacy, attracting a new generation of digital-savvy gamblers.

The Global Competitive Landscape

Digital technologies level the playing field, allowing small businesses to compete globally. Small and medium-sized enterprises that use digital platforms export five times more likely than those that don’t.

This increased competition drives innovation. Companies must continually improve their products and services to stay relevant. Those that can’t keep up risk obsolescence (just look at the fate of once-dominant companies like Kodak or Blockbuster).

Collaboration has gone global. Open-source projects like Linux demonstrate how distributed teams can create world-class products. GitHub, a platform for collaborative coding, hosts over 200 million repositories, showcasing the power of global collaboration.

Final Thoughts

Digital economies reshape our world at an unprecedented pace, transforming industries, consumer behavior, and the nature of work. We expect the pace of digital transformation to accelerate, with emerging technologies further blurring the lines between physical and digital realms. This rapid evolution brings opportunities and challenges, creating new jobs and business models while raising concerns about privacy, cybersecurity, and the digital divide.

Adaptability becomes essential for individuals and organizations to thrive in this new landscape. Those who embrace digital technologies and update their skills will position themselves best for success. Policymakers must ensure the benefits of digital economies are distributed equitably and appropriate safeguards protect consumers and workers.

At Piter, we stay at the forefront of this digital revolution. Our platform, Wolfbet, exemplifies how traditional industries can reinvent themselves for the digital age. We meet the evolving needs of digital-savvy consumers by offering a top-tier crypto gambling experience with substantial bonuses and a focus on user privacy.